What are the new off-payroll rules?

Up until now, contractors earning a rate of £220 per day or more or on contracts of more than six months have had to provide assurances to the relevant public sector body that they are outside of IR35. These thresholds do not apply to the tax rules.

As from 6th April 2017, the responsibility for assessing a worker’s employment status will shift to the public authority, agency or third party paying the intermediary. They will also be responsible for deducting and paying over any PAYE tax and NIC (including employers’ NIC) to HMRC where IR35 applies.

When is the legislation effective?

The new rules, to be introduced via Chapter 10 of Part 2 ITEPA 2003, will apply to payments made on or after 6th April 2017 and can therefore apply to contracts entered into before that date if they straddle 5th April 2017. If work is completed before 6th April 2017 but payment made on or after 6th April 2017, then it will fall within the new legislation.

Who does it apply to?

Workers providing their services through an intermediary to a public authority will be subject to the legislation. A public authority is one that is defined for the purposes of:

- Freedom of Information Act 2000

- Freedom of Information Act (Scotland) Act 2002

This definition covers government departments and their executive agencies, many companies owned or controlled by the public sector, universities, local authorities, parish councils and the NHS. It will not however apply to organisations like GCHQ, who are not subject to the Freedom of Information Act.

The rules will apply where:

- A worker personally performs services, or is under obligation to personally perform services for the client

- The client is a public authority

- The services are provided under circumstances where, if the contract had been directly with the client, the worker would be regarded for income tax purposes as an employee of the client or the worker actually is an office holder with the client

How will public sector bodies determine a contractor’s status?

HMRC will provide an online tool: Employment Status Service. The questions used in the tool will be based on case law and HMRC will provide clear and simple guidance explaining technical terms, how the questions might apply and what to do if the circumstances of the contract change. The tool will be updated to reflect any new case law.

Where the tool cannot provide a definitive answer, HMRC will provide guidance and support.

HMRC’s technical note, contains a number of illustrative scenarios but mostly in situations where the new rules are likely to apply, particularly where the worker is:

- Required to work at the end client site

- Supplied with equipment by the end client

- Directed in their work by a manager or other officer of the public sector body

- Leading a team

The one example that involves a contractor, Jasmine, working to a local authority and is not caught by the off-payroll rules is obvious as she:

- Works mainly from her own office

- Provides her own equipment

- Employs her own staff

- Meets her own costs and expenses

Another example, Janice, highlights the point that although a contractor may be involved with a public sector body during their work, if they do not have a contract with that organisation then the new rules cannot apply. Here, Janice’s own company is contracted by a building company to project manage the building of a new wing at a hospital managed by an NHS Trust. Although she has a degree of interaction with the Trust managers, who have an interest in her work, Janice’s contract is with a private company and therefore not in the public sector. As such, the off-payroll rules do not apply and Janice must consider whether or not IR35 applies. In making this decision she will be able to use the online Employment Status Service, should she choose to do so.

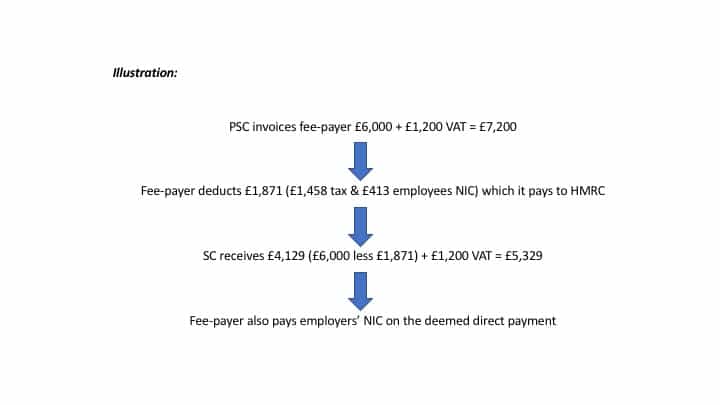

If the engager decides the new rules apply then they will deduct tax and NIC from the contractors’ VAT exclusive fee before payment is made and the worker is treated as receiving a deemed employment payment.

The public sector client must inform the intermediary, agency or third party with whom they have a contract whether or not the contract falls within the off-payroll rules. This conclusion can be included in the contract or separately. Where the public sector body fails to provide such notification, then a request may be made in writing that the information be made available, together with the reasons supporting their conclusion. Failure to respond to such a request within 31 days of receipt will result in the public sector body becoming responsible for accounting for PAYE.

To enable the “fee payer” to deduct the correct amount of PAYE tax and NIC, the worker will be legally required to provide their National Insurance number, tax code and identity details.

For tax and NIC purposes, the worker is treated as having an employment with the fee payer, so once the contract ends they will be given a form P45 and, presumably if the contract spans a whole tax year, form P60. The relevant pay and tax details will then be entered on the contractors’ employment supplementary pages of their self-assessment tax return.

However, a contractor will not be:

- entitled to statutory payments

- subject to student loan deductions

- enrolled in to the authority’s pension scheme

Corporation tax, expenses and pension contributions

A PSC will be allowed a corporation tax deduction up to the full amount of the deemed direct payment to prevent double taxation. This will be equal to the net fee. So, in the above example this would be £4,129.

Should the director decide to extract the full £4,129 as salary, then no further deduction of tax or NIC by the PSC is necessary, otherwise this will have been taxed twice. This will however have to be reported to HMRC as non-taxable payments on the Full Payment Submission (FPS) of RTI reporting.

Alternatively, a tax-free dividend up to the total of the net fee received can be paid and which does not have to be reported on the directors’ self-assessment tax return.

A PSC will still be able to make pension contributions on behalf of the contractor with relief being obtained through the company.

Whilst the IR35 5% allowance to cover unspecified expenses has been removed, HMRC have said that PSCs will still be able to claim allowable business expenses but what will be the mechanism for overheads that do not count as expenses of employment, such as accountancy for instance? If these are only going to be allowable for corporation tax purposes and the PSC’s entire income consists of fees earned from a public sector contract caught by the new rules, then it will incur losses that will either be relieved by carrying back to an earlier year or carried forward to the next accounting period.

The government says it has no immediate plans to extend the new rules beyond the public sector but it is difficult to believe this especially when HMRC is faced with future resource and budgetary challenges.

There has been concern that many public sector organisations will adopt a safety first policy and treat all workers as being caught. Whilst a contractor is at liberty to appeal a decision this would mean inviting an IR35 enquiry and could end up in the tax tribunal, which is both time consuming and costly.

For further information regarding this or any of our contractor accountancy services please contact us today.

More Blogs

How Much Does a Director Loan Cost?

Director loans are a popular yet often misunderstood financing method used by small business owners. If you’re a company director who has taken, or is considering taking, money out of your company (that isn’t structured and subject to tax as: a salary, dividend, or expense reimbursement), then you are effectively using a Director Loan. It is therefore important to understand these rules and the costs involved.

Do I Need to Use a Separate Bank Account for My Sole Trader Business?

One of the most common questions we receive when clients are setting up as a self-employed sole trader for the first time, or indeed for existing businesses who transfer into us is: “Do I need to use a separate bank account for my Sole Trader business?” The article explains the benefits of using a separate bank account for business transactions as a self-employed sole trader.

Is It Better To Be Self-Employed Or Use a Limited Company?

The article helps business owners decide how best to structure their business, by considering the differences between operating as a self-employed sole trader or partnership, or by using a limited company.